All Categories

Featured

Table of Contents

It permits you to budget plan and strategy for the future. You can easily factor your life insurance policy right into your budget plan due to the fact that the costs never alter. You can plan for the future equally as conveniently because you understand precisely just how much cash your enjoyed ones will certainly obtain in the event of your lack.

This holds true for people who quit smoking cigarettes or who have a health condition that settles. In these instances, you'll usually need to go through a brand-new application procedure to get a far better rate. If you still need protection by the time your level term life policy nears the expiry date, you have a few alternatives.

Most degree term life insurance coverage plans include the choice to renew coverage on an annual basis after the first term ends. the combination of whole life and term insurance is referred to as a family income policy. The cost of your policy will certainly be based upon your current age and it'll increase annually. This can be a great choice if you just need to prolong your insurance coverage for 1 or 2 years or else, it can get expensive rather swiftly

Level term life insurance policy is one of the most affordable coverage choices on the market because it provides standard security in the form of fatality advantage and just lasts for a collection duration of time. At the end of the term, it expires. Whole life insurance policy, on the other hand, is significantly extra expensive than degree term life since it doesn't expire and comes with a money value feature.

Quality Guaranteed Issue Term Life Insurance

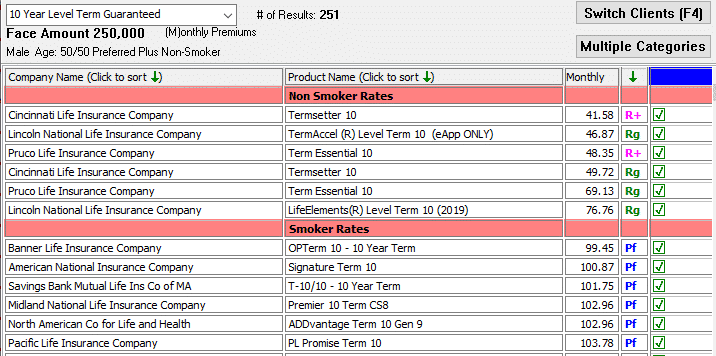

Rates might vary by insurance firm, term, protection quantity, wellness class, and state. Degree term is a great life insurance alternative for a lot of individuals, but depending on your insurance coverage requirements and individual circumstance, it may not be the finest fit for you.

This can be an excellent option if you, for instance, have just stop smoking cigarettes and need to wait two or 3 years to use for a degree term plan and be qualified for a lower price.

Innovative Level Term Life Insurance Meaning

, your death benefit payment will certainly reduce over time, yet your repayments will certainly stay the exact same. On the other hand, you'll pay more in advance for less protection with an enhancing term life plan than with a degree term life plan. If you're not certain which type of plan is best for you, functioning with an independent broker can assist.

When you have actually made a decision that level term is best for you, the next step is to acquire your policy. Below's just how to do it. Compute just how much life insurance policy you require Your protection quantity must supply for your household's long-lasting economic requirements, including the loss of your earnings in case of your death, as well as financial debts and day-to-day expenses.

A level costs term life insurance coverage strategy lets you stick to your spending plan while you aid shield your family. ___ Aon Insurance Providers is the brand name for the broker agent and program administration operations of Fondness Insurance coverage Solutions, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Fondness Insurance Firm, Inc. (CA 0795465); in OK, AIS Affinity Insurance Services Inc.; in CA, Aon Affinity Insurance Services, Inc.

The Strategy Representative of the AICPA Insurance Coverage Trust Fund, Aon Insurance Coverage Solutions, is not affiliated with Prudential.

Latest Posts

Best Funeral Plans For Over 50s

Burial Insurance Quote

Burial Life Insurance Policies